Do want a great deal on home? Would you like to use renovation financing instead of using your own savings?

You came to the right place.

I’d like to help you understand foreclosures and short sales, explain the renovation process, give you tips on choosing a contractor, and unfold how to flip a home (resell it).

Let’s get down to it.

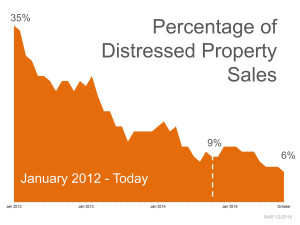

Foreclosures and short sales are both distressed sales but differ from each other. While most short sales are soon to be foreclosures, not all foreclosures were short sales. Here’s the breakdown:

What Is A Foreclosure Property?

The homeowner has stopped making payments and the lender gives notice that the homeowner is in default. In the notice the lender will give the homeowner a certain amount of time to bring the payments current or the lender will sell the home to the highest bidder at auction. If the lender can’t sell it at auction, it places the property on the open market. (Note: that there are no inspection and no financing contingencies allowed at auctions, making this type of transaction a very high risk venture for anyone other than experienced investors.)

By the time the property hits the open market, the lender is willing to deal. Why? Because banks must still pay real estate taxes, property maintenance costs, and other fees. Moreover, some municipalities impose special fees to banks and institutions for owning vacant properties. Finally, let us not forget that the lender faces even more losses due to the opportunity costs of having money tied up in a non-performing asset.

By the time the property hits the open market, the lender is willing to deal. Why? Because banks must still pay real estate taxes, property maintenance costs, and other fees. Moreover, some municipalities impose special fees to banks and institutions for owning vacant properties. Finally, let us not forget that the lender faces even more losses due to the opportunity costs of having money tied up in a non-performing asset.

Pros:

- Quick purchase process (usually 30 days)

- Discount pricing

- Great for flipping

Cons:

- Property condition issues

- Competitive offers

- Length occupant eviction process if you buy at auction

What Is A Short Sale?

A short sale occurs when a homeowner is in foreclosure, but sells the home before the property is put up for sale at auction. Under a short sale, the lender must agree to accept less than the amount owed (take a short) on the property or no deal. Sellers can strike a deal with the existing lender to take less then what is owed because it may be in the lender’s best interest to avoid the foreclosure process. The added expense of the foreclosure process can cost the lender as much as 40% of the original investment.

For your sanity, focus on foreclosures and short sales that are vacant. If theses distressed properties are occupied it just adds another layer of problems you have to be dealt with, including eviction.

Pros:

- Discount Pricing

- Usually in better condition than foreclosures

- Great for flipping

Cons:

- Lengthly purchase time (90-365 days)

- Short sale lender may not approve sale

- Occupied short sales & foreclosures add to the drama

Now that you understand distressed properties lets learn more about your financing options.

(NOTE: If you are currently in the market for a home. Click here for a free list of North Houston, Spring, & The Woodland’s area foreclosures.)

Renovation Financing

In the past, you needed three loans to complete a home rehabilitation. The first loan was to purchase the home, additional financing to fix it up or rehabilitate it, and lastly permanent financing to pay of the first two loans when the home is completely built.

The FHA 203k loan is the government’s solution designed to address this complicated situation. You can just get one loan with 3.5% down plus closing costs, and finance the acquisition and the rehabilitation. The funds you receive must be less then 110% of the property’s after repair value (ARV). FHA loan limits very from county to county. The loan limit for a FHA loan in Montgomery County, Texas is $326,000, which means the cost of acquisition and rehab cannot exceed $326,000

After renovation appraised value is $250,000

Purchase Price $200,000 + Rehab Costs $40,000 = Loan Amount $240,000

(√ This deal works)

What can be included in the rehab when using a 203 k loan? (not limited to this list)

-

- Repair and replacement of structural damage

- Add a bathroom

- Add an addition

- Finish bathrooms

- Remodel kitchens and bathrooms

- Change siding

- Eliminate obsolescence like a carport or covered porch

- Replace plumbing, heating and electrical systems

- You can even install new plumbing fixtures of interior whirlpool bathtubs

- You can install a new sewer or septic systems

- Roofing, gutters downspouts

- Flooring of all types and carpeting

- Energy conservation improvements like double pain windows, insulations doors, solar systems caulking and weather-stripping

- Landscaping, patio and decks, fences driveway walk

- Trees can be removed if they are a safety hazard.

- new appliances and paint and also swimming pool repair

- Improvements for accessibility to a disabled person

What things cannot be included in a 203k rehabilitation? Not limited to this list repair of:

-

- Barbecue pit

- Bathhouse

- Exterior hot tub, sauna, spa or whirlpool bath

- Outdoor fireplace

- Installation on new swimming pool

- Gazebo

- Satellite dish

- Tennis court

- Trees cannot be removed unless the tree is a safety hazard

FANNIE MAE has a conventional mortgage product designed especially for renovations called the HomeStyle Renovation Mortgage. The HomeStyle Renovation is very similar to the FHA 203k. This mortgage product allows you to purchase a home and borrow up to 50% of the after repair value of the home to use towards, renovations, repairs, or improvements. Benefits of this mortgage product include:

- Up to 6 months of your mortgage payment (PITI) can be financed into your loan.

- 5% down downpayment for a single family home, townhouse, or condo.

- 15% down payment for a investment properties

- Very broad scope of what can be included in renovation.

Next, choosing a contractor is a crucial part of a successful deal.

How To Choose A Contractor

A referral from a friend or a low priced bid isn’t the best way to choose the contractor who’ll end up being responsible for such an important and expensive project. Getting a referral is great, but also do your due diligence.

Ask for list of references. The contractor should be able to give you the names, addresses, and phone numbers of at least three clients who have projects similar to yours. Ask him about jobs he’s currently working. Your lender will also ask the contractor for references, and may even pull his credit report.

Call the references and ask the following:

- Can I visit your home to see the completed job?

- Were you satisfied with the project? Was it completed on time?

- Did the contractor keep you informed about the status of the project and any problems along the way?

- Were there unexpected costs? If so, what were they?

- Did workers show up on time? Did they clean up after finishing the job?

- Would you recommend the contractor?

- Would you use the contractor again?

Texas does not issue home improvement licenses so you’ll have to rely on rating websites like Yelp!, and the Better Business Bureau.

If they have multiple employees, verify that they have worker’s compensation insurance.

Also, ask your contractor to get bonded. Being bonded means that a bonding company has secured money that is available to you, the consumer in the event you need to file a claim against the contractor. The secured money is in the control of the state, a bond, and not under the control of the contractor. Let’s say that you hire a contractor and they disappear, never to be heard from again. Well, you would file a claim against the company and, after an investigation, would be paid out by this bond.

Here’s what the whole process looks like:

The Purchase & Renovation Checklist

-

- Get a Pre-Approved for a renovation mortgage

- Locate the property

- Preliminary market analysis with Realtor (need a Realtor? Contact us)

- Estimate extent of renovation

- Estimate rough cost of renovation

- Complete an as-is and after repair market value evaluation of the property

- Draft purchase offer

- After offer is accepted

- Order home inspection

- Consult with real estate agent about required lender repairs

- Work write up or contractor bid

- Appraisal

- Lender prepares the loan package

- Application is reviewed and all financial information is verified to establish the ability of borrower to repay the mortgage

- Establish maximum insurable mortgage amount (based on appraisal and write up)

- Lender issues commitment to lend

- Mortgage Loan closing

- Rehabilitation Escrow Account is established

- Rehabilitation Construction begins

- Homeowner had 6 months to complete work

- During construction process funds are release after the work is inspected by a HUD – approved inspector, or appraiser.

- Completion of Work/Final Inspection

- If there is unused contingency reserved funds or mortgage payment reserves in the account, the lender must apply the funds to prepay the mortgage principal

Now let’s talk about the re-sale.

The Flip (Part II coming soon)

Have a question?

Ask a member of the SpringHomeSearch.com real estate team! Contact us here.

(NOTE: If you are currently in the market for a home. Click here for a free list of North Houston, Spring, & The Woodland’s area foreclosures.)