Current Houston Market Indicators:

Current Houston Market Indicators:

The Woodlands

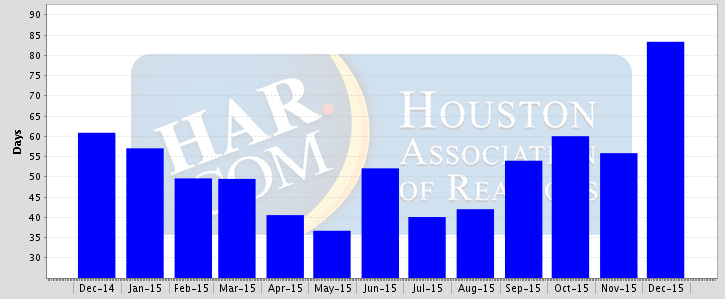

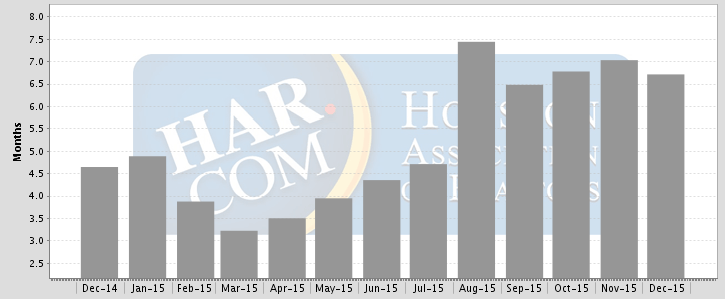

We will not see a nosedive in all Houston areas, but in The Woodlands a slow down is happening. The average number of days houses sit on the market has increased from 35 in May to a whopping 83 in December, proving that it is taking most home owners longer to sell in The Woodlands. The months’ supply of inventory is way up too, all the way to 7.5 months in November. Statistics like this point towards a buyers’ market, and sellers should prepare to lower their expectations, and consider budgeting for very aggressive offers from buyers.

The Woodlands Average DOM & Months Supply of Inventory Dec (2015)

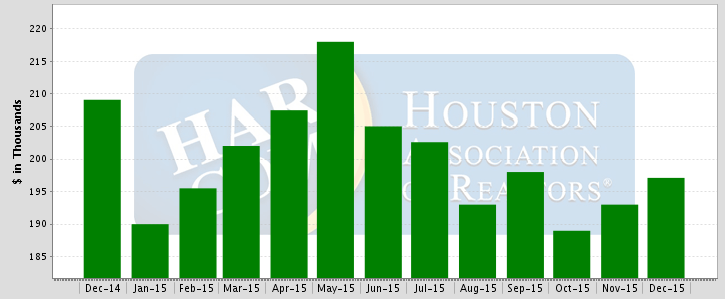

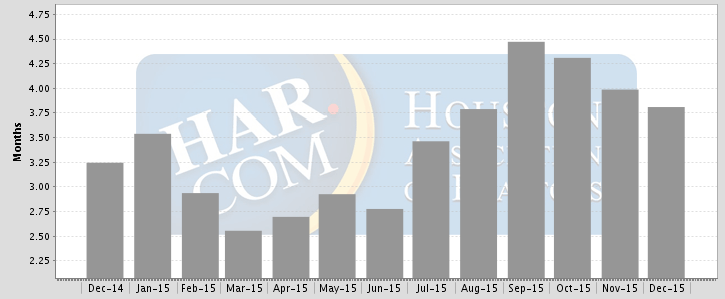

Spring Texas

Spring, Texas Median Sold Price & Months Supply of Inventory Dec (2015)

Buyers on the fence should buy now while there’s plenty of inventory and rates are still low. Position yourself with aggressive offers, and expect counter offers because sellers are still adjusting to the news that their homes aren’t worth as much as they were just last summer.

Sellers should prepare for a fierce spring/summer market. Homes that didn’t sell in the winter, plus new spring/summer inventory should push prices even lower. Wait-and-see buyers who are concerned about gas prices may sit out the market until things stabilize. Home staging and correct market positioning is going to be extremely important. Sellers have to make sure they are the best deal on the block.

In The News

Development set to stabilize in county in 2016: Continued population growth on the horizon for The Woodlands

Albeit at a slower pace, more new residents, homes and developments are expected throughout The Woodlands area and Montgomery County in 2016. Montgomery County was named the seventh fastest growing county in the U.S., according to census data released in 2015.

Morgan Stanley sees oil bust as worst since at least 1970: Bank says this crude crash more intense than mid-’80s collapse

Oil prices dropped again… extending 2016’s unbroken losing streak and worsening a bust in Houston’s key industry that is shaping up as the most severe in almost half a century.

2016 Economic and Housing Outlook: Q&A with James Gaines

The Houston market is expected to go into down turn in 2016 according to James Gaines, Chief Economist with Texas A&M Real Estate Center. “I think the housing market will slow down a bit in 2016. It’s not going to fall off a cliff, though,” comments Gaines.

BP to cut thousands of more jobs (Video)

BP PLC (NYSE: BP) plans to cut about 4,000 jobs by the end of 2017, the Associated Press reports.

Fed finally raises interest rates, prepares to lower them when economic collapse accelerates

Reserve chair Janet Yellen went on to note that increases would be incremental and spread over time, but also would remain low for the foreseeable future. The admission, though, that the Fed needed some wiggle room is troubling.