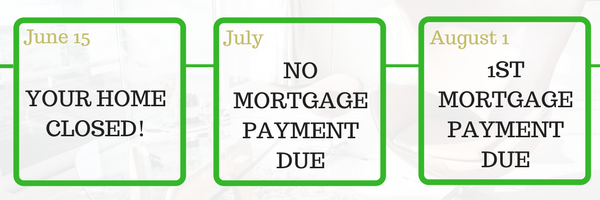

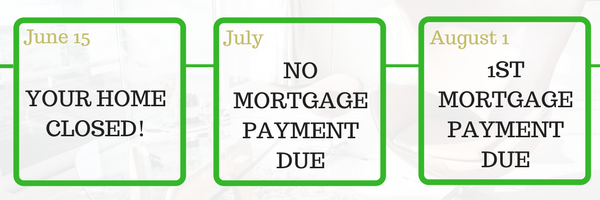

What Happened In June & July?

Try to close as early as you can in the month, and technically, you can get a free month’s mortgage, by getting someone else to pay for it. Here’s how: Your August payment covers the interest in July. Any interest amount From June 1-31 was covered with your interest prepayment at closing. Here’s the best part, your interest prepayment can be paid by someone other than you, i.e. the lender, the seller, and or down payment assistance. Check out this short video to learn how to get your closing costs paid on your behalf.

What Are Closing Costs?

- Fees and payments for the real estate transaction that are due at closing

- Most common closing cost is the down payment

- Closing cost typically cover third-party services – generally, lenders don’t have control over fees

- Standard items include, title insurance, appraisal, credit report, flood certification, and escrow fees

What Are Pre-Paid Costs?

- Costs related to the home itself, not the real estate transaction

- Usually include property taxes, homeowners insurance, mortgage interest, and homeowner association fees

- May be required to pre-pay theses costs even though they’re not due until a later date

- May also have to pay for these cots for the full loan term or for however you own the home

What Is Your Cash To Close?

- The entire amount you pay on the closing date to finalize the home purchase

- Any down payment plus all closing costs and prepaid items make up the cast to close

- Paid by a wire fund or with a cashier’s check made out to the escrow compaany

Our Goals

- To give remarkable service for remarkable you

- Be your trusted real estate resource year after year

- Offer you so much value that you will feel comfortable introducing us to your friends and family members.